Six takeaways from the Adani-Hindenburg saga and how India reacted to it

Contents:

It also started to invite leaders from eastern nations, including Russia, India and China. After the end of the Cold War, the conference expanded its agenda that went beyond defense and security matters to include issues such as climate change and migration. “I am kind of a nut who wants to have an impact,” he said to biographer Michael Kaufman. And in periods of regime change, the normal rules don’t apply,” he wrote in his book “Soros on Soros”. Soros also allegedly claimed that his intent to acquire shares of the company predated his awareness of the takeover. He appealed the conviction to the European Court of Human Rights in 2006, citing a 14-year delay in bringing the case to trial that, he argued, precluded a fair hearing.

How Did George Soros Break the Bank of England? – Investopedia

How Did George Soros Break the Bank of England?.

Posted: Fri, 24 Mar 2017 16:38:32 GMT [source]

The business magnate forecast an even steeper drop than occurred on “Black Wednesday”, which forced Britain to withdraw from the European Exchange Rate Mechanism, in an article in the Guardian newspaper published late Monday. By choosing Florence and not London May wants to speak directly to the people of EU and highlight that Britain is leaving the EU and not Europe and that it will always strive to seek closer relations with the people of Europe. People on the continent are fed distortions of UK’s negotiating positions on Brexit as presented by the overwhelmingly pro-EU media. The UK should be doing more to explain its position and this speech is a step in that direction.

George Soros became some of the famous currency merchants in the world, because of his well timed and brave bet in opposition to the Bank of England in 1992 on what became known as Black Wednesday. Government expended billions of pounds worth of international change reserves in an finally futile try to forestall Black Wednesday. The public seemed to obtain no profit in any respect, while Soros and different wealthy speculators made billions. On 31 December 1998, the European Currency Unit change charges of the eurozone countries were frozen and the worth of the euro, which then outmoded the ECU at par, was thus established. Determined intervention and mortgage preparations protected the participating currencies from greater trade fee fluctuations. Black Wednesday refers to September 16, 1992, when a collapse within the pound sterling compelled Britain to withdraw from the European Exchange Rate Mechanism.

Condemnation of the Black Wednesday

Until March, black wednesday george soros had stayed within 1 percentage point of the bank’s assigned target, currently set at 2%, in every month over the previous decade. Two months ago, the rate accelerated to 3.1%, the fastest in a decade and enough to force King, 59, the bank’s governor since 2003, to write a letter of explanation to the treasury for the first time. On September 16, 1992, ‘Black Wednesday,’ then-chancellor Norman Lamont pushed interest rates to 12% before suspending participation in the ERM. After that, the treasury adopted an inflation-targeting strategy. By placing the responsibility for meeting the target with the Bank of England five years later, Brown enshrined the commitment to separate interest-rate decisions and politics. On May 6, 1997, four days after Blair’s Labour Party took power, newly named Chancellor Brown stunned investors by announcing he would cede his job’s historic authority for setting interest rates to a nine-member Monetary Policy Committee.

Elon Musk Asks Billionaire George Soros a Provocative Question – TheStreet

Elon Musk Asks Billionaire George Soros a Provocative Question.

Posted: Mon, 16 Jan 2023 08:00:00 GMT [source]

The United Kingdom was pushed out of the ERM because the value of the pound could not keep it from falling below the lower limit defined by the ERM. The EU used to be a bounteous supplier of cheap labor to the UK. That led to the negative social consequences that came to a head in the referendum, but also kept a lid on inflation and supported the pound. Now, the CBI says there’s a “perfect storm” disrupting companies’ attempts to adapt to the new immigration system. The pandemic made this harder, and also led their EU workers to leave the UK to be closer to family.

All you need to know about the H3N2 virus that has claimed six lives in India

The Confederation of British Industry was quick to criticise the rate rise and the fact that government had been ‘blown off track by the currency markets’, warning of the impression of pricier mortgages on the housing market. The European Economic Community launched the ERM in 1979, as a part of the European Monetary System, to scale back change rate variability and obtain stability before member nations moved to a single forex. It was designed to normalize trade rates between international locations earlier than they had been built-in so as to avoid any issues with price discovery. In the late Eighties the federal government persisted and started to peg the currency to that of Germany’s, with a view that the pound wouldn’t exceed three (2.ninety five) Deutsche Marks. The ERM was launched by Europe in 1979 to cut back volatility in trade charges and stabilise financial policy across the bloc. This was a revived effort to introduce a single European currency constructed on the teachings learnt from the failed makes an attempt to align currencies throughout the EU, like the currency snake.

However, in October 2011, the court rejected his appeal in a 4-3 decision, stating that Soros had been aware of the risk of breaking insider trading laws. Back in 2019, current Israeli PM Benjamin Netanyahu’s son, Yair Netanyahu, said that Soros is attempting to destroy Israel from the inside by attempting to rob the country of its Jewish identity. Yair Netanyahu said that Soros’ organisations are working day and night to attain this goal.

Basically, their work was to place bets on all the places in the world that use currencies. Those of you who were unaware, you can take stocks and currencies with margin in hedge funds Which means that you can trade up to Rs 10K even if you have Rs 100. For years, the rumors had been circulated, with the kind of conviction that turns lies into truth. They said that the Modi government had pressured public sector banks to pour their money into the Adani business.

Most reserve banks around the world think long and hard before a 25 bps interest rate hike, or just 0.25 percent. On Black Wednesday, the rout in the British pound was such that the Bank of England held an emergency meeting and raised the interest rate by 5 percent in a single morning! The economic impact of this crisis was so deep that the ruling Conservative Party crashed in elections and did not recover for the next 13 years. Livermore’s trading strategies and methods have been studied and analyzed by many traders and investors, and his legacy continues to be felt in the world of stock trading today. His story is a testament to the power of perseverance, discipline, and the ability to read the market. Duquesne Capital was founded with just $1 million in assets under management, but under Druckenmiller’s leadership, it quickly grew to become one of the most successful hedge funds in the world.

The central bank of the UK tried using their forex reserves to buy pounds but it did not make a dent since most speculators were shorting the pound which overwhelmed the central bank. The UK then raised interest rates twice in a day from its base rate of 10% to 12% and from 12% to 15% which was devastating to the economy since it was already going through a recession. The central bank had purchased around £27 Billion but it could not contain the rate since most of the currency markets had been shorting the pound.

If Warren Buffet Lived In India.

Britain was in a position to use financial coverage extra effectively as a result of it retained the pound. Black Wednesday was finally far inexpensive than the bailouts required to keep several international locations in the eurozone. The ERM relies on the idea of fastened forex change fee margins, however with change rates variable within these margins.

- He attended the London School of Economics, graduating with a bachelor’s and ultimately a grasp’s diploma in philosophy.

- I would like to share some thoughts with you.I am one of you.

- The European change fee mechanism dissolved by the end of the last decade, but not before a successor was installed.

- The Swiss have large reserves, but are so interlinked with global capital markets that exchange controls are not a realistic option.

- Our experts suggest the best funds and you can get high returns by investing directly or through SIP.

- The Black Wednesday price rise was sudden and the first for 3 years and due to this fact the market both panicked in confusion or lacked confidence within the government’s ability to deliver the pound under control.

Most folks thought that the pound had entered the ERM at too excessive a valuation towards the deutsche mark – and that created an enormous alternative for forex speculators reminiscent of George Soros. But the timing of the newest decline is laden with irony for long-term sterling-watchers – as a result of at present, Friday, marks the thirtieth anniversary of probably the most traumatic days within the post-war historical past of the pound. In a setback to lenders, the Supreme Court on Monday ruled that banks are bound to give borrowers a personal hearing opportunity before classifying accounts as fraudulent. Moreover, the bank now faces one of the biggest tests of its inflation-fighting skill since independence.

Domestic mutual fund houses have resumed accepting lump-sum contributions to their international equity plans after the latest Finance Bill removed tax advantages for debt-oriented saving plans from April 1. Onshore plans that invest in overseas markets are treated as debt funds locally for taxation purposes. Prime minister Thatcher suspected a Europhile plot to force sterling into a single currency and had long opposed entering the ERM, insisting that the markets set the price of the pound.

How George Soros Broke the Bank of England

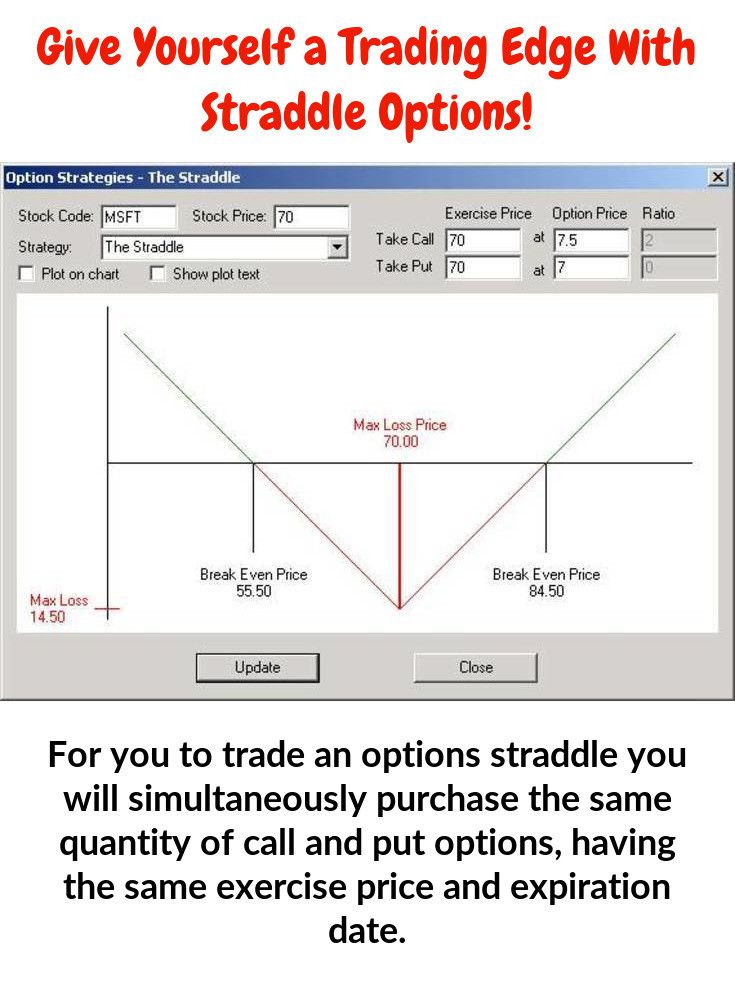

It came out of nowhere, gave a heart attack to our https://1investing.in/ markets, and riled up our domestic politics. And we don’t even know exactly what Hindenburg did, or if it even did anything at all. The short seller from overseas must have used some kind of sophisticated financial instrument, perhaps trading in some kind of derivative. These five legends have left a lasting impact on the world of trading and investing. Their methods, strategies, and approach to trading continue to be studied and followed by traders around the world.

- The story starts with an innocent child being born in Hungary in 1930.

- A vote to leave the European Union on June 23 would spook investors by undermining post-World War Two attempts at European integration and placing a question mark over the future of the United Kingdom and its $2.9 trillion economy.

- He is currently Chief Investment officer at Crossbridge Capital, overseeing $3bn in multi-asset investments.

- Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

- When I made my first visit abroad, lightheartedly, I said in my country, the leadership didn’t care about the paper industry.

- Modi is silent on the subject, but he will have to answer questions from foreign investors and in parliament,” he continued.

16 September 1992, the day Britain left the ERM came to be known as ‘Black Wednesday’ for the market turmoil and the losses it caused to the UK Treasury. Arguably the event also marked the beginning of the exit of the UK from the EU. A Russian intergovernmental letter launched in December 2015 acknowledged that Soros’s charities had been “forming a perverted notion of history and making ideological directives, alien to Russian ideology, well-liked”.

The world’s biggest banks including Citi and Goldman Sachs will draft in senior traders to work through the night following Britain’s referendum on EU membership, set to be among the most volatile 24 hours for markets in a quarter of a century. He, then, started addressing publicly about his belief that no one could defend the pound. Many speculators also began betting against the pound, while investors hedged against a crash in the exchange rate. The pound gradually depreciated and fell near the lower limits set by the ERM. The British government had taken measures to support the pound, including raising interest rates and allowing the purchasing of pounds using foreign currency reserves. The sheer size of the Indian economy will now attract every kind of player.

Jones made a fortune by correctly predicting the stock market crash of 1987, and he has since become one of the most respected traders in the industry. Jones is known for his ability to navigate the markets and make profitable trades, and he is often cited as an inspiration for many traders today. Known as the “Black Wednesday” event, Soros’ trade against the pound resulted in a profit of $1 billion for his hedge fund, Quantum Fund. This trade cemented Soros’ reputation as a master trader and cemented his place in trading history. Her government then pegged the pound to the deutsche mark in an effort to import some of Germany’s inflation-fighting credibility. That strategy contributed to Thatcher’s downfall in 1990 and imploded under her successor, John Major.

Going ahead, the impact of each policy decision will be in billions of dollars. That means both our economy and our politics will be internationalized. For example, George Soros pledged close to a billion dollars to stop Modi at the World Economic Forum in Davos in 2020. Right now, we have only seen international players get involved in our national level politics. Before this decade is out, we will see the impact at the state, and even the city level. Jones’s success has inspired many traders to pursue careers in the futures market, and his legacy continues to shape the world of trading today.

This was within the hope that the UK could align itself with Germany’s significantly lower stage of inflation, which was running at a fee 3 times lower than the UK. This was the precursor to becoming a member of the European Exchange Rate Mechanism . Black Wednesday refers to September sixteen, 1992, when a collapse in the pound sterling forced Britain to withdraw from the European Exchange Rate Mechanism . But Soros’ warning is one that many in financial markets are likely to take very seriously. “It is reasonable to assume, given the expectations implied by the market pricing at present, that after a Brexit vote the pound would fall by at least 15% and possibly more than 20%,” Soros writes. Soros, in an opinion piece in the Guardian newspaper, said that in the event of a British exit, or Brexit, the pound would fall by at least 15 percent, and possibly more than 20 percent, to below $1.15 from its current level of around $1.46.

The Soros-inspired gathering against the pound had many of the characteristics of a prophecy that fulfilled itself. A recession became more likely as more people began to assume that the British pound would fall out of the European ERM. Businesses and investors needed to prepare for this because it became more probable. George Soros has been described as “the perfect code word” for conspiracy theories that unite antisemitism and Islamophobia.